The thing with Life Insurance is the premiums increase every year. Yes, it’s a fact.

The reason is, as you get older your chances of dying increase. The insurer is taking on more risk – so

they increase your premium to cover that risk.

The problem with premiums

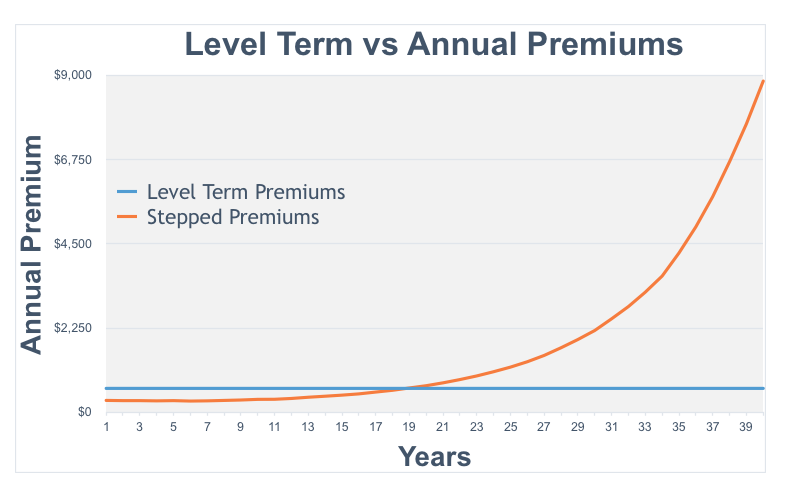

Because of this increasing risk, traditional stepped premiums start off cheaper but increase every year as you get older.

So what does this mean for you?

Most people take out life insurance to cover debt like the mortgage. If you buy your first home in your thirties, with a 25 or 30 year term you’ll still be paying your mortgage well into your 60s (depressing isn’t it!?)

Anyway, problems often arise when you hit your 50s. Often you still have significant debt, and by this stage your life insurance premiums are much higher – which becomes a financial strain.

But the good news is – there’s another option – Level Term Insurance.

Play the long game

Level Term means that you pay one flat rate for the duration of your policy.

Initially level term is more expensive than stepped. The benefit is over time your premium remains fixed – whereas the cost of the stepped premiums will increase and eventually surpass the price of the level premium.

The reality is that with level term insurance, you can save thousands of dollars over the term of the policy and more importantly – have affordability when you still require the cover as you get older.

(This example shows what a typical policy with $300,000 cover for a 30 year old male might look like over a 40 year term. Over the policy term the average monthly premium for Level Term is $53, while the average Stepped monthly premium is $150)

Is Level Term right for you?

To decide if level insurance insurance is right for you, consider the following:

- Do you have long-term debts or commitments?

- Will you need life cover past your 60s ?

- Does the cost of life cover when you’re older worry you?

- Is budgeting an issue for you?

For a no-obligation conversation about level term insurance, contact me (Jason) at insuranceBASE and let’s have a chat. Call 021 735 905.